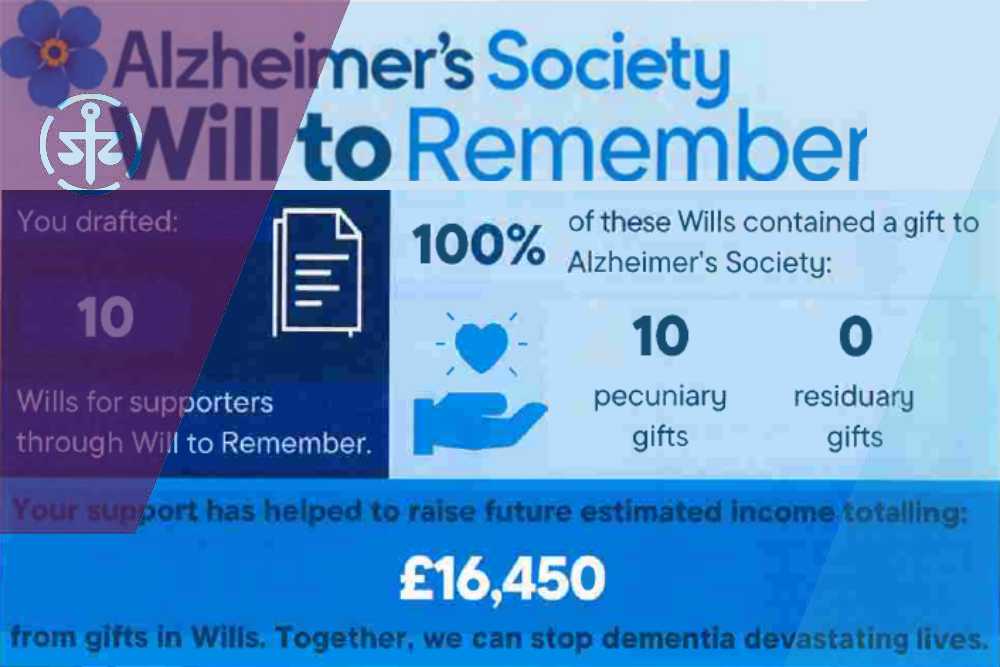

We’re proud of our 100% commitment to the Alzheimer’s Society’s Will to Remember scheme. By drafting Wills with charitable gifts included, we help raise money for vital dementia research and support. Join us to make a difference with your legacy to this amazing charity that can benefit us all.

Your pets are part of your family, so you need to care for them in your Will. We look at ways you can provide for animals after your death.

Professional Estate Planning Services Throughout Essex and South Suffolk Based in Braintree, Cunningtons Solicitors provides expert estate planning and probate services in Essex and South Suffolk, through it’s network of local branches across East Anglia. We are now offering our services around Colchester, Ipswich, Harwich, Manningtree, Hadleigh, Tiptree and other local areas. Our comprehensive services […]

Starting a New Year with a Legal Health Check means you can ensure that your Will is up-to-date, you have the right LPAs set up, and your family is in good hands if the worst comes to the worst.

Your LPA can be more important to you than your Will, and helps you more than your husband or wife can. Learn why your LPA can be your superhero!

Contesting a Will is not something you do when you are simply disappointed with your share. Has there been undue influence? Or testamentary incapacity? We look at the options

Building on our introduction to probate disputes and contentious probate, we delve deeper into this area of law and provide the details of some real-life cases and how inheritance disputes are dealt with in practice Before going further, if you have not got a Will yet and wish to leave your estate to your loved […]

A look at the much-maligned inheritance tax, and how writing your Will correctly with a well-trained solicitor can reduce your anxieties.

Using a Deed of Variation you can legally change a Will – but there are strict conditions. It is a way of reducing your inheritance in favour of someone else.

Cunningtons regularly participates in Farleigh Hospice’s Make a Will charity campaigns, and 2023 was no different. Cunningtons helped them raise £13,144.20 this time …

It’s easy to forget to update your Will, and forgetting to write a Will is easy too. Don’t leave your loved ones to deal with intestacy or an outdated Will.

All staff at Cunningtons complete basic Dementia Friends training. This makes them aware of the issues that some of our clients may be facing.