> BUYING & SELLING PROPERTY

TIPS AND ADVICE

Can you trust the Property Information Form?

In September 2019 Cunningtons wrote a post (My Seller Lied To Me!) explaining the consequences of misrepresentation when selling property, particularly when it comes to the seller’s Property Information Form TA6.

It didn’t take long for the comments to start flooding in …

As buying a home is often the most expensive purchase most of us make, it’s important to get things right when you are buying a house. Consumer protection is crucial in this process, as you may expect someone who’s selling a property to know a lot about their house when they put it on the market, and to tell the truth to anyone who’s thinking of buying it.

What is the Seller’s TA6 Property Information Form?

To encourage a true and constructive exchange of this information, the Seller’s Property Information Form (otherwise known as the TA6) was introduced by the Law Society. The form covers quite extensively most of the issues that could be cause for concern with a property purchase, ensuring that all material information is disclosed early in the selling process. But it is NOT a legally binding document, as it says in the small print at the end:

“… in relation to the physical condition of the property, the replies should not be treated as a substitute for undertaking your own survey or making your own independent enquiries, which you are recommended to do.”

It should come as no surprise to find out that sometimes a seller does not accurately complete their Property Information Form – and not always deliberately – misleading in a potential purchase. It is a surprise, though, when a seller finds that lying on a property information form is not breaking the law!

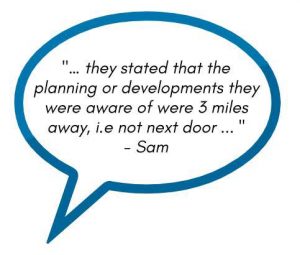

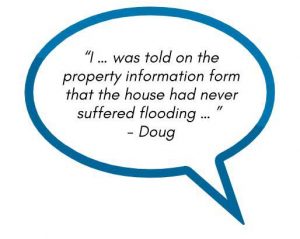

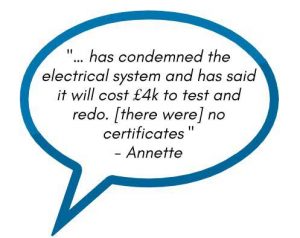

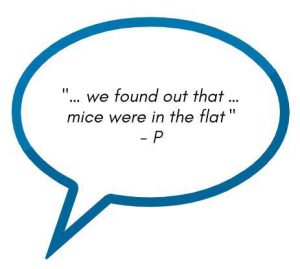

Comments from disappointed buyers

Our post has received many comments, many of them frustrated at issues that buyers believed the purchase process should have brought up. Clearly, engaging in contact early on between sellers and their solicitors can help address potential issues that may cause delays in the property sale process.

Cunningtons are Property solicitors, and part of what we do is Conveyancing. However, our misrepresentation post has encouraged people to contact our Civil Litigation department about Property disputes, as the conveyancing has been done and they are now, in law, owners of their new property.

What is abundantly clear from the comments is that many of the issues could have been dealt with before completion – and even before exchange – with a little extra work by the buyer. And though the Law does protect them, it’s easier to deal with these issues before purchase!

How do I avoid property misrepresentation when I’m buying?

There are a number of constructive guides to help you with the process of buying a house, including Cunningtons’ own guide to buying. The changes to the TA6 Property Information Form aim to create better-informed buyers by providing essential property information early in the home buying process. And it’s worth taking the time to make sure you are as informed as possible. Read all the documents and forms involved, ask questions if you’re not sure, and get written answers.

As top buying agent Henry Pryor told us:

“… people seem to approach buying a house with as much care as they might when buying a takeaway sandwich. I always document what I’m told and double-check it so that if in due course there is a problem then one has a paper trail that points to who might have made the mistake.“

Henry Pryor

Caveat emptor – buyer beware – even though it’s a phrase in a dead language, is very much a live issue today.

Here are the 7 issues that drove home buyers to want to make a claim

1: Claims made in marketing materials

It should come as no surprise to you that marketing does not always tell the truth. The conveyancing process involves ensuring all necessary permissions are in place to prevent delays and potential sales falling through. So when the estate agent’s details of a property you are interested in say it is ‘freehold’ or ‘share of freehold’, you should check that this is correct.

You can do this for free by visiting the Land Registry, or it might cost £3 for a printed copy. And if there’s any confusion, speak to your conveyancing solicitor as you progress toward exchange.

You should never rely on any information in a glossy brochure about amenities, it is there to inspire your interest only.

If you are sufficiently interested to move forward with a purchase, you should request written confirmation of any services, and ask your conveyancing solicitor to check the wording before moving on.

2: Planning permissions

There were a number of comments where a buyer had assumed that planning permission had been granted for extensions and other building works. Assumptions can be costly, and checking is easy. Check for free at https://www.gov.uk/search-register-planning-decisions, and contact the specific local council if you are still unsure.

Any and all extensive building work should have been signed off and have full planning permission. That phone call to the council costs nothing – and can save heartache and expense.

You can also check the council tax band, which can reassure you that a property is correctly registered as a private residence.

It is also important to check that there are no upcoming planning applications in your area that would diminish enjoyment of your new home; this includes noisy building work on your neighbours’ homes as well as large housing developments nearby that would increase noise and traffic levels during and after completion.

Once again, checking with the local council is important and inexpensive.

Your conveyancing solicitor can also carry out a Planning search if you request this which will give a wealth of local information about planning applications, as well as crime rate, schools, medical facilities, and other issues.

3: Flood risks and historical floods

Flooding is both one of the most harrowing things that can occur with your new home, and it is also one of the easiest issues to predict before sale. When you are completing your Property Information Form prior to putting your home on the market, you would obviously be keen to downplay any flood problems.

However, if you check https://flood-warning-information.service.gov.uk/long-term-flood-risk you can ascertain the potential of any property to flood. The service is free.

You can easily check the height of a property above sea level, if you are taking a more long-term view.

You can also check the Flood Risk For Planning map: https://flood-map-for-planning.service.gov.uk/, for more reassurance.

4: Electrics, gas, water, sewers, boilers and phone coverage

Flooding can also come from burst pipes and poor workmanship within a property. If you have any concerns about this, you can stipulate it when you are ordering your survey, or pay a plumber to come and have a look.

The same goes for electrics – if you have concerns, you should check the electrical supply before exchanging on a property. You can order a safety check, as if you were a landlord, or get an electrician to check. Look at the existing systems, especially if it looks updated recently. This is particularly important if you are buying an older property.

Another issue we have found is the condition of the boiler – it can be a good idea to ask for a demonstration of it functioning. Ask the vendor to run it for a few minutes to verify that it heats up properly. If the house has oil-fired heating it is also important to check the tank and supply lines as clearing heating oil spills is very costly and disruptive.

The most expensive utility on a property would be a septic tank. If you are considering buying a property that uses a septic tank, it might be a good idea to have a separate survey undertaken. You should also find out the date it was last emptied.

And all appliances and fixtures should have their documentation, particularly something as expensive and important as boilers and septic tanks.

Phone coverage can be another bugbear, and just looking at the phone company’s coverage map is often not enough. To verify the mobile phone signal, you have to:

- ask the owner,

- ask the neighbours, or

- try it yourself.

5: Pest infestations

It is difficult to detect a pest infestation without checking through a house yourself, as it is not a standard question on the TA6.

Although if there has been a serious issue it could well have been reported to the local council – so this is another item to put on your list of questions to them.

6: Japanese knotweed

An unwanted guest that we surprisingly had no comments about was the famously invasive Japanese knotweed. The TA6 does have a question for sellers to complete on this issue but you should bear in mind most sellers are not horticulturalists and may not recognise it, and so any answer is going only to be based upon whether they have had a problem.

This is something you should be asking your surveyor to check, not only on the property itself, but neighbouring gardens too. Another question to ask the neighbours.

7: Invasive tree roots

Not quite as foreign as Japanese knotweed, but just as invasive, tree roots in the wrong place can cause huge problems with drainage and subsidence.

You should make it clear in the instructions to your surveyor that these need to be checked, if you have concerns.

Otherwise, if you think there is a problem, ask a local builder or a tree surgeon to see if there is a problem.

Ways of preventing misrepresentation

Ask The Land Registry

You can find out a good deal about property boundaries and ownership at The Land Registry website. This is where you go to get basic information about your proposed purchase – and it’s not expensive.

If you are relying on extra space that you assume is part of the property, such as a parking space and access, make sure it’s part of the plot as stipulated in the property’s Land Registry entry.

Ask your conveyancing solicitor to check too, as they will not necessarily know there’s an issue unless you tell them. If you are not sent the plan to check, you should ask for it, and make it clear if there’s any land you think is included which is missing from the plans.

Check the neighbourhood

There’s a lot of information to be gained by walking around the local area at different times of day. Can you see anything that makes you feel nervous about your prospective purchase? Are there noisy roads? You can also spot things that might make you concerned about flooding or development, without having to spend any time online.

You can see if there are the amenities you need, and get a feel for the area – something that is difficult to achieve using the Internet. Are there large open spaces which might be developed and change the nature of the area? Again, a Planning search can provide information on current applications.

Ask the neighbours

Unless the neighbours have been specifically asked not to speak to any potential buyers by the existing owners, they are a potential mine of information.

They live in the area, they probably know the vendors, and they will probably be keen to be helpful to anyone who is thinking of becoming their new neighbour.

Asking the neighbours can be particularly useful if you are thinking of buying a newbuild property in a development – as all the houses are probably built to the same standard, you can have advance warning of anything to look out for.

Chatting to neighbours could also be a way of detecting any undisclosed disputes. Lying about disputes with neighbours is also a fairly common misrepresentation complaint.

And, of course, another huge benefit of asking the neighbours is that you get a chance to introduce yourself to people who could potentially become YOUR neighbours.

Order a full buildings survey

If you’re buying a separate survey, there is little point unless you buy a full buildings survey. It may save you a lot of money, and even allow you to negotiate a cheaper price if you are forewarned of any issues. However, when you order a survey make sure you understand the scope of the work to be undertaken.

If you are assured of anything verbally, make sure you also get it in writing, and mention it to your surveyor if it needs physically checking.

Buyer beware indeed!

It might be helpful to read all the comments on My Seller Lied To Me! to get an idea of what can go wrong – and take them into consideration.

As Charlie H posted in a refreshingly positive comment:

“I just wanted to say thank you for this very informative blog of some very sad events that occur when sellers don’t complete the TA6 honestly. And of course how important it is to understand caveat emptor. Being aware of all the ‘tricks’ that may be pulled ensures being forewarned to be forearmed … “

Charlie H

As you can see, there’s a lot you can do yourself to make sure you spend time talking to our Conveyancing department instead of our Civil Litigation team.

Questions people ask us about Property Information Forms and misrepresentation

What is property misrepresentation and what are property misrepresentation claims?

There is no specific definition of this but broadly this could be described as a claim which arises by reason of a misrepresentation occurring during a property transaction.

How does misrepresentation in property transactions happen?

If a seller says something about the property you are buying which is not true, then a claim for misrepresentation can arise, but this will depend on the terms of the contract.

The seller has lied on the property information form but I haven’t exchanged contracts, what should I do?

You should consider asking for the seller to clarify the position, remedy the defect or problem or perhaps negotiate the purchase price.

What should a seller disclose when selling their property?

The seller does not have to disclose anything but if they do not, then a buyer might decide not to take the risk of buying the property. Normally a seller will fill out a property information form. For residential purchases, the Law Society published a standard property information form for this purpose, called a TA6 or a TA7.

Hi, Is there any way I can access TA6 from the sale of my neighbour house. Are these forms recorded and stored anywhere? I need to find out what the previous owner said about boundary between our house and their as the new owner thinks he has right to our wall and he thinks it’s a party wall rather than a wall on our land. We are in a process of applying for Exact Boundary Line and he is not agreeing with our surveyor and does not want to sign the form. So I just wanted to see if he thinks this way because perhaps the previous owner misled him?? Thank you.

Thank you for your comment.

No. There is no right to see such documentation and it is not stored anywhere that a third party could

access it. It might be stored on a solicitor’s file, depending on how long ago the transaction was or the

neighbour might have a copy.

Sometimes, particularly if legal proceedings are likely or extant, it is possible to apply to the Court for an

order that documentation relevant to the dispute is disclosed. However, this is a fairly strong step to

take. Asking for a copy is always the first thing to do anyway.

In any event, what a property owner/seller says about a particular boundary is not necessarily going to

have any probative value when compared to a surveyors report. Neither a court nor tribunal would

have any real regard for the understanding of a particular party. The courts and tribunals operate on

evidence. That evidence need to be supplied by qualified individuals.

My seller, investigator and realtor have all been in on the same cover up in regards to the sale of my home and there was so much that was not disclosed and covered up because they were all in on the same deal and receiving something in return that they refused to disclose things that came to light 💡 and I was unaware of until the insurance company asked me something about it later on that I should have known about but, was unaware that they had covered it up to make it look like it was a new roof and it wasn’t it was just a patch job that they had done to make it look like it was new. Plus there was a huge hole in the roof and they didn’t fix it and they only covered it up. So now I’m having trouble with the house all these years later, or really I’ve been in the house for about a year and a half and all of these problems are starting to come up that weren’t even apparent until now and I just don’t know what to do about it because it’s not even covered by anything.

Thank you for your comment.

We are not certain precisely what the issue is, but we assume that repairs had been undertaken to the

roof of the property that you were proposing to purchase and this was not disclosed to you.

The basic position is that it is the remit of a buyer’s seller to check that the property is in a condition that

is satisfactory to their buyer client. It isn’t generally for a seller, seller’s estate agent or the solicitors

(who are not surveyors) to point this out.

Concealing issues with a property is not uncommon. A seller will want to get the best price they can for

it. It is generally up to a buyer to ask the questions that they want answers to as to the condition of the

property. Sometimes, if an answer is given, which may in itself be factually accurate but because of

something which is also relevant is not explained, it creates a misleading situation and the buyer knows

this, this can give rise to a basis of claim in misrepresentation. Concealment of relevant issues can

sometimes be evidence of this but would not in itself give rise to a claim unless there was a

corresponding obligation to disclose the underlying issue which has been concealed (which there

generally isn’t).

We purchased a property on a private road where the ownership is restricted to the land the house sits upon and the surrounding parking and gardens are ‘communal’ and managed by a company in which you become a member upon purchase. There is an annual maintenance fee of £1000.00 for each property for the parking, pavements and gardens. The gardens are maintained by contractors. However, over time, one end property has decided to replace planting and deck out an area for seating which they now treat as ‘theirs’. How is this compatible with the surrounding properties being regularly sold as being in ‘communal’ gardens?

Thank you for your comment.

We cannot give legal advice on our website, if only for the fact that the relevant deeds and title documentation in relation to the properties would have to be considered.

On the assumption that there is a validly enforceable restriction, perhaps a restrictive covenant, then arguably denying those individuals with the benefit of such restriction their ability to exercise their rights in relation to communal land, this would give rise to an actionable cause of action. It strikes us that the remedy sought would need to be an injunction obliging the infringing individuals to reinstate that which they have sought to acquire for themselves.

Hi,

I’m in the process of buying a property.

I haven’t had it surveyed (yet) however the surveyor did some due diligence before arranging a visit.

It turns out there was work performed in 1992 on the property as documented on the building control website. This was done BEFORE the seller moved in.

However from the photos he also noticed that similar was performed on other walls in the kitchen (archway) etc with a beam above. This work has not been documented with building control.

As this was perhaps done before the moved in the early 2000’s, what should I do?

There is no paper work on building control for this, they might not even know themselves that this work was done.

As a buyer what would some good guidance be ?

I have been reading up that you can get retrospective building control but obviously risks to this if it’s knocked back. It can delay the sale (fine by me) or the seller could pull out altogether I’m guessing if it requires that the work is restored to its original state

Equally indemnity insurance would only cover me for work requested from the council, and not for any future repairs of said refurbishment.

As it wasn’t the seller that initiated this work though how can I navigate this effectively ?

Thank you in advance

Thank you for your comment.

A solicitor would be unlikely to advise you whether or not to proceed with the transaction, unless they were specifically retained to advise you on the financial merits of it. Whether or not to proceed is ultimately your choice based on your appetite for risk. Normally, the extent of a solicitor’s obligations would be to identify risk involved in the transaction that would not be obvious to their client, rather than advise whether or not proceeding was a good or bad idea.

It sounds as though your surveyor is on the ball and very much worth whatever fees are being paid to them. Likewise, if you have been advised about the possibility of indemnity insurance (often a common “solution” to such issues), then your conveyancer is alive to the risks to you and has advised you of your options. However, ultimately the decision to proceed or not is yours alone based on their professional advice.

What we can say is that the basic position is “buyer beware” and it is therefore up to the buyer to obtain the necessary information that they require and decide whether or not to proceed. This normally means asking the seller the right questions and consulting with professional advisors about the position. This is the primary reason for appointing professional advisers. Whilst there is a cost involved, it is always worth it to minimise the risk of becoming committed to purchase a property which has issues which may be of concern to a buyer. A buyer would be well advised not to assume that there is any sort of recourse to the seller (or any other third party) after the transaction completes and therefore should be taking whatever steps they can to address points that are of concern to them. A client should never feel that they cannot ask questions of their professional advisors, because that is what they are for, but as mentioned, whether or not to proceed is likely to be a matter for you based on the information you can obtain and the professional advice about the risks given to you.

Hi,

I have an escalating neighbour dispute over a fence that was replaced with a brand new one due to potentially erroneous boundary information on my property information form. Not only that, I strongly believe the previous owner’s were aware that this boundary wasn’t shared as noted on the PIF because they engaged in a similar dispute over the fence with the same neighbour, which must have been resolved one way or the other. This dispute was also not disclosed in the form but while trying to sort a compromise with the neighbour, was clearly tasty enough that they felt compelled to mention that they had to involve the solicitors and local council (a thinly veiled threat).

I did inform the neighbour of my intentions in advance. He told me it wasn’t a shared boundary, it is his but that he was fine with me replacing the fence as it is old. He asked whether I would paint his side and I said I would. I checked the PIF form which stated they are shared and assumed it was just him trying to assert authority (he’s a known problem neighbour). I then went on holiday and while away, the builder’s replaced the fence.

My neighbour is now looking to take me to the cleaner. His 25 year old rotten fence has been replaced with a brand new fence at my expense, however he is insistent that I flip the panels so he gets the ‘front’ side and also paint them brown, as agreed prior. I’ve said as a compromise that I would willingly paint the back. He has refused this offer and has threatened legal action. His only solution is that I flip the fence and paint it brown at my expense. I offered a further compromise of nailing ‘fronts to the back’ which is a technique to make a panel double sided, if he would be willing to contribute. He’s refused this compromise.

Obviously I’m £240+labour down over the fence which is now looking like a questionable investment but I’m also now locked in a really unpleasant dispute with a neighbour and it all originates from the fact I based my decision to proceed off the PIF.

Please advise how I should proceed.

Thank you for your comment.

We cannot provide specific advice on our website. What we can say is that it would always be more cost effective to try and reach a compromise with a difficult neighbour.

Boundary and neighbour disputes almost always quickly become out of hand and can have a long lasting impact on the ability to sell a property, which is probably why your seller was not overly keen to provide information about any historical issues.

The starting point would certainly be to ascertain where the boundary is and whose responsibility this is. Without wishing to sound disparaging, sometimes this comes down to educated guess work on the part of a surveyor if historical deeds are not available. We would also need to consider exactly what was agreed with your neighbour to decide whether the previous agreement reached about replacing the fence has compromised their ability to enforce any rights; it may be that they cannot now do so.

As for the seller, the ability to pursue a misrepresentation claim will depend on the terms of the contract agreed (which may exclude any right to pursue a claim for misrepresentation) and precisely what was said to you about the situation. It is vital to prove that the facts you were given were misleading. Silence about any fact does not ordinarily give rise to the ability to pursue a claim.

Hi there, in a bit of a pickle (very much on topic): I sold a leasehold rental property in 2021. Now years later later, the buyer has come back with a staggering bill for works that were supposedly notified to us via postal S20 notice back in 2020. Never received, possibly the tenants chucked the letters away along with all the spam, who knows. If i ever owed any money to freeholders, they simply chased via email. so I was never too concerned about missing post… until now that is.

During conveyancing in 2021, the freeholders (a major social housing landlord) were explicitly asked by my solicitor to issue all outstanding works notices. They failed to issue anything of the magnitude of the bills in question. There seems to be no other record of this notice from 2020 or since. I also don’t know whether the works were carried out during my ownership or after the sale.

So who’s liable now? The new owner’s solicitor is particularly accusatory and threatening to sue. In fact accusing me of intentionally covering up this S20 notice. I question their professionalism on that front to be honest.

Not sure there’s a straight answer here.. but thank you anyway.

Thank you for your comment.

Sadly this is not an uncommon situation and local authorities in particular can be very slow to issue notices and invoices for major works, which can then come as a huge shock. It does cause all sorts of issues for poor leaseholders looking to buy or sell a property.

The basic position will more than likely than not be that the current owner is liable for the costs. This is why they are so upset. Payments falling due under a lease will generally be payable by the existing tenant.

Sometimes within the contract of sale, especially for leasehold properties, there are apportionment and retention clauses aimed at mitigating or preventing a buyer becoming liable for something the seller “should” be liable for (in the sense that the works are attributable to the seller’s period of ownership). For example, if service charge accounts have not been published at the point of sale and it is therefore unclear how much could owed by the seller and buyer for their period of ownership, the buyer might ask the seller’s solicitor to retain a certain sum from the proceeds of sale on account of this liability. By way of simple explanation, if a service charge is normally about £1,000 per year and the sale takes place halfway through the year, the buyer might ask the seller’s solicitor to hold on to £500, which would be a reasonable estimation of the cost, until the landlord or management company issue their demand for payment. That sum is then passed to the buyer to pay this. Sometimes there is a balancing payment to or from the seller required.

These sorts of clauses need to be considered in detail, so the contractual effect of them can be accounted for. You could be contractually liable for the sum now demanded from your buyer. However, if that were the case, they probably would have argued this already.

It sounds as though you have been accused of misrepresentation. A misrepresentation can be made innocently. For contrast, reckless or fraudulent misrepresentations can also be made. This is why someone does not care about the accuracy of what they say or knows what they are saying is untrue, respectively.

An innocent misrepresentation is still actionable. Whilst it is sometimes a defence to say what was said was substantially true (which might be relevant here), it is generally no defence to say that I represented something believing it to be true. If you are going to represent something, it should be done accurately.

The contract of sale may contain (and it usually does) a clause excluding liability for all but reckless or fraudulent misrepresentations, which may be why you are being accused of trying to conceal matters, to avoid this contractual agreement having any effect on your potential liability.

Where a defence (possibly a secondary defence after the point above regarding contractual liability for innocent misrepresentation) to this matter lies might also be in the question of reliance. See our article: https://cunningtons.co.uk/reliance-in-misrepresentation/

The buyer must have relied on what was said when deciding to proceed with the purchase. It is also generally not a defence to argue the buyer could have discovered the truth, but if it can be shown that on the information provided it could not possibly have been the case that the buyer relied on the implied suggestion that there would be no future liability to them in respect of what is now claimed, this would likely carry considerable weight in a Court.

We suggest you get in touch with us as soon as possible to discuss the matter further.

Hi

The seller has admitted to repeatdly lieing in the Commercial Pre Contractural Enquiries Form, and other direct written communication with him.

We have bought the property £495,000 based on the information the seller gave, he lied about sole water connection and how many people connected to the sewage treatment plant. We do not have a sole

water connection and we have discovered a Deed of Easement for another property to connect to our sewage treatment Plant, our Solicitor failed to report on.

How are we protected by the Law in this instance?

Thank you for your comment.

We cannot give specific advice on our website.

Whether or not there is a misrepresentation claim against your seller will depend on the contractual terms agreed and what was specifically told to you by the seller. If it was factually inaccurate and you relied on this when entering into the agreement to purchase the property, there may be a misrepresentation claim.

Likewise, if it can be said that your solicitor should have identified matters, and the test is what a reasonably competent solicitor should have advised about, there is the possibility of a professional negligence claim.

What we do not understand for your comment and which will be very relevant to matters is what you hope to achieve. The law exists primarily to compensate those wronged. This is normally done with an order for damages. Thought therefore must be given to, in crude terms, how much your claim is worth.

Much of the time, damages in misrepresentation claims are assessed by reference to diminution in value. This is the difference between what the property was worth when it was purchased (normally what the buyer paid) and what someone would pay for it knowing about the issue in question. Whilst we would need input from a surveyor as to this figure, if everything “works” at the property and the risk of problems is relatively low (if this is the case) then we do question what impact on the value of the property there would be.

I moved into a shared ownership flat in April 2022. On the LPE1, we were told that there was no anticipated S20, being issued in the following 12 months.

Shock horror after finding out we are being over charged service. They sent us a S20 saying the drains need fixing. We then found out cctv survey was done in 2021, with no action on housing association’s part as it was too costly. (But cost of living crisis is good time to do it)

This was not on any of the documents from my solicitor and housing association document to use didn’t have it either.

Lease said I should get seller to give me a discount. Is this the right way forward?

Not sure we would have moved in if we knew this problem was ongoing since 2017

Thank you for your comment.

We cannot say the extent to which the seller may be liable for any misrepresentation. Much would depend on what you were told by them and the contractual terms involved.

As for the LPE1, if it can be said that the landlord made a factually inaccurate statement about anticipated Section 20 notices, there is a possibility of a claim against the landlord for misrepresentation. However, an obvious defence to the matter would be that as at the time the statement was made, they did not envisage a Section 20 notice being served, therefore the statement was not factually inaccurate.

You may be better of considering whether or not there is scope to challenge the reasonableness of any charges in the First Tier Tribunal (Property Chamber) on the basis that the inactivity or possible failure to maintain the property (so far as this is a requirement in the lease, as it probably is) has caused an excessive charge.

My seller said there hasn’t been a complaint on the TA6 form, against his neighbours, but we’ve since found out from the council that there was two complaints, a letter was sent but the issue was resolved and the people who the complaint was about have moved,

Thank you for your comment.

Whilst there may be a misrepresentation claim, it is important to think about the practical aspects of your matter. The legal system exists to compensate those that have suffered a loss by the wrongs of others. The Courts are also extremely mindful of the question of proportionality. Put in the most blunt of terms, the Court would not be overly impressed with entertaining a claim where the cost and Court time in pursuing it would be significantly greater than any benefit that the person pursuing the claim would receive.

If the issue has been resolved, it probably is not worth spending time and effort in looking into matters further.

Hi Jon,

I have purchased a leasehold in a council-owned block.

Before the sale the seller disclosed there will be works on the property, and told us via purplebricks (NOT via the solicitor) that the rateable value calculation is 1%. Which costs £5k.

When our solicitor enquired on the same lines, the enquiry was ignored or told “we’re not sure, we can’t confirm”, we proceeded to exchange on the basis of the message from the seller.

The ratable value is 4%, and the works are £20k.

Do we have a basis for a claim, or will we be told that we cannot trust any information not communicated via a solicitor, and it is our own fault for believing the sellers message at face value.

George

Thank you for your comment.

We are sorry to hear of this. Major works on blocks of flats are always difficult and contentious area. The seller wants to sell before they are hit with a bill but the buyer won’t want the liability for them.

We often see attempts by sellers to avoid drawing attention to prospective charges.

The situation can broadly be summarised as:-

1. It is up to the buyer to make sure they have enough information about service charges and major works before committing to the purchase. This is specifically one of the questions asked in the TA7, leasehold information form.

2. Sometimes it is simply not possible for the seller to know what the precise charge might be. Landlord/freeholders are entitled to serve notices which do not specify the particular cost sometimes. However, details of those notices should be disclosed by the seller if asked about by the buyer.

3. It isn’t unusual to agree some sort of retention of part of the purchase monies to take account of forthcoming charges. The seller doesn’t have to agree to this, but broadly it is an agreement that one of the solicitors retains some monies and when the actual cost of the service charge is known, the cost is deducted from the retention and balance paid to the buyer.

This is a difficult question to consider without seeing more documentation. We are also a little confused about the reference to rateable value, which is something that comes up more often in commercial property matters.

Firstly, we would need to understand the basis of the charge. If it is based on the rateable value, then arguably any misrepresentation may be based on a false statement of law i.e. the factually inaccurate statement was that legally, the rateable value was X%. Normally a statement of law or opinion is not actionable. Only a statement of fact is. There is some case law which supports the argument that a false statement of law is actionable, but it could present an issue for you.

The second issue we see is of reliance. For any misrepresentation claim to exist, the buyer must have relied on what the seller represented. The seller appears to have latterly and effectively said “we don’t know” in which case it is questionable whether or not it can be said you relied on the earlier representation.

We are sorry that we cannot provide more general guidance, but your comment is quite specific and we cannot give specific advice on our website, if only for the fact that, as you can appreciate, we do not have a full understanding of matters.

If a seller was a convicted sex offender does this have to be disclosed on the TA6 form? What can be done if it wasn’t disclosed?

Thank you for your comment. No, there is no obligation on a seller of property to disclose any personal criminal convictions to a prospective buyer.

In fact, there is no obligation on a seller to provide any information about a property at all if they do not want to. Clearly a buyer is not going to purchase a property if a seller is not going to answer the buyer’s questions, so for practical reasons, the buyer does generally provide information and answer questions, even though that legally, they do not have to. The only “obligation”, so far as it can be considered such, is to provide factually accurate information. This is not really an “obligation” per se, but the seller risks a claim if the information they provide is not accurate, so they should be careful to ensure that it is.

We have discovered shared drainage and also separate drainage belonging to our neighbour located on our land 8 years after purchasing our property after undergoing some building work. We have checked our TA6 form and the vendor did not disclose this information.

The section on notices and proposals where you are asked if you know about any negotiations or changes that affect the property the vendor has said NO. We have found out that a meeting took place between our vendor, the neighbour and a drainage expert and they all agreed to adding 2 new soakaway and a concrete roof rainwater gully. They agreed to shared usage to dispose of the roof rainwater from both properties. Work went ahead and was completed and our vendor did not disclose any this information. She also had a Septic Tank added at the same time the drainage was added but she only told us about the Septic no other work was mentioned.

We had to replace the shared soakaway during our building work and we have new neighbours now who have refused to pay for any of the work claiming no liability. We have been left with a £3000 drainage bill to cover which has placed us in debt.

What should we do?

Thank you for your comment. As previously discussed it is not a misrepresentation to fail to volunteer information about the property. However, if they were asked about something on the Property Information Form, and stated that it was not an issue when asked, that is a false statement and can found a claim in misrepresentation.

Therefore, to bring a claim in misrepresentation you need to show that this statement that there were no negotiations or changes to the property was false, which means you will need to evidence that the meeting you say took place did, in fact, take place. You will then need to show that your reliance on this statement, on which you were entitled to rely, caused you to lose out. It is likely you will be entitled to rely upon the statement made but you will have to show that the meeting took place and that the seller clearly knew this was what the question was referring to and clearly knew that there was such an arrangement. This will likely mean obtaining a Witness Statement from the previous neighbour.

The other point to note is that if your losses are only the £3,000 bill you refer to this is likely a small claims matter and as such it may not be economical to bring this claim. However if there are other losses that you can recover as well as this it may be possible to do that as well. Please feel free to contact the Braintree office and speak to the Litigation team for a confidential discussion.

I’m committed to purchase an auction property based on the auction pack and TA5 info. I have discovered the out buildings are solely owned by one property despite joint use of all four properties. I am concerned the title deed owners can rescind right of use should I renovate to building standards. The vendor stated there was no issue with easement or flying freehold and that gas was supplied to property.

Do I have a post purchase claim?

Thank you for your comment.

Whether you have a claim depends on exactly what the vendor said to you in the auction pack. To have a claim in misrepresentation requires that you be able to point to a false statement by the seller, on which you relied, and on which you were entitled to rely, and as a result of which you have undergone a loss. It is not enough therefore for the seller simply to have failed to volunteer information to you as there is no legal duty on them to do this.

In addition, this being an auction contract it is likely that there is a battery of non-reliance and entire agreement and exclusion clauses in the contract which prevent you from relying on any representation other than in cases of fraud. You would need to show that the misrepresentation was something that the seller knew about or could reasonably have known about at the time he made the representation on which you relied.

I also note that you say that you are committed to purchasing the property. Does this mean that you have yet to complete on the sale? In an auction sale the fall of the hammer is considered the exchange of contracts so if you are the top bidder you are legally bound to do this. If so, then you will need to decide whether you want to complete on it. If you do complete on it this may act as a bar to rescission and any claim may be in damages only when it comes to misrepresentation, but if you do not complete then you will likely lose your deposit and be liable for the costs of and occasioned by the seller of your breach of contract (subject to the content of the contract, that is). You therefore will need to make a decision as to whether you would want to complete the contract and the solicitor acting for you on the purchase may be better placed to advise you on this point.