Summary

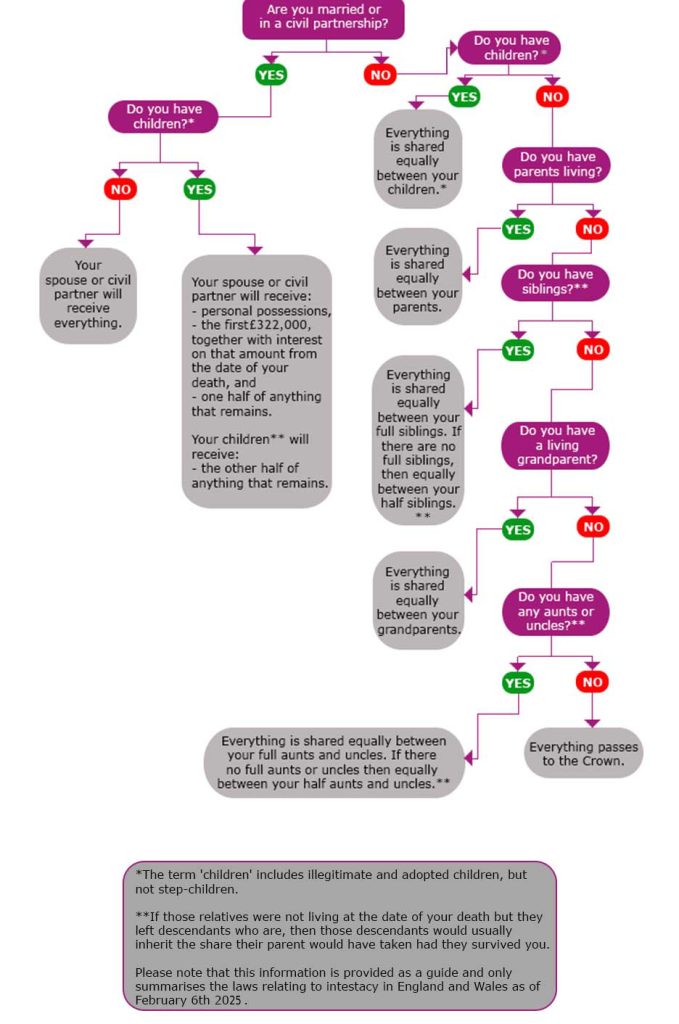

Our Intestacy Rules Flowchart goes through all the steps taken to decide what happens if you die without having a valid Will. It is important to stay informed about any legal updates to the Laws of Intestacy, as changes can significantly affect the distribution of assets.

If you have not written a will when you die, you are considered to have died ‘intestate’.

This chart shows what happens to your estate if you die intestate in England or Wales in 2025.

Key questions asked if you die intestate

Are you married or in a civil partnership?

You need to be either married or in a legal civil partnership for your other half to inherit your estate automatically.

Do you have any children?

If you are married or in a civil partnership, your children will receive half of your estate between them.

If you are NOT married or in a civil partnership, your children share your entire estate equally. They can make no variations to a Will because there is no Will.

What about the rest of your family?

Should you have no children, or no legal spouse / civil partner, your parents share your estate. If your parents are no longer alive, your estate is shared equally between any brothers and sisters you have.

If you have no siblings, then the estate reverts to your grandparents. And if you have no grandparents, to any aunts and uncles, equally.

And if no family are entitled to inherit?

If you have no legal spouse / civil partner, children, parents, siblings, grandparents, aunts or uncles, or cousins … the crown collects everything.

How do I stop this from happening?

Simple. If you want to have control over your estate and what happens after you have died, you need to contact your solicitor to make your Will.

Your life could end at any time, and it takes very little time to write a Will that protects those you care about when the worst happens.

Contact Cunningtons solicitors about making your Will – none of us want to think about it, but you’ll feel better once it’s done.

Visit our branches for more information: Braintree, Brighton, Chelmsford, Croydon, Hornchurch and Wickford.

Hi, My brother has just been contacted by an Heir Hunter company and we have just found out my Nan had a Niece who has passed away and they are now trying to find the beneficiaries of her estate.

It seems she had no Spouse/Children or other family members that are living, My Nan has passed and my father who was her son has also passed, she has a surviving daughter (My Aunty) will the estate of my Nans Niece be entirely left to my Aunty or will it be distributed between my Aunty and my Dads children?

Thank you for your enquiry.

The Heir Hunters will research your family tree to ascertain the relatives of your nan’s niece, once they have made contact with beneficiary they will verify identification and then usually provide a copy of the family tree. Without sight of the family tree I cannot accurately comment as to how the estate will be distributed. If your father would have ben a beneficiary under the rules of intestacy and predeceased then his share will pass to his children.

As you are now seeing the rules of intestacy can be complex, if you have not done so already I would urge you to consider having a Will which would set out who would deal with your estate and where it would pass to in the event of your death.

I have a brother who is single has never been married or has ever had a civil partner and has never had any children.

I am married and have 3 adult children.

neither of our parents or grandparents are still alive.

In the event of no will from my brother who will his estate go to?

My brother will not talk about any issues relating to death, he is now 68 and I am worried that myself or my children if I have passed may end up with a huge problem trying to sort this out.

Also are there any downloadable documents that clearly lay all this out that I can print off for him? He does not use computers or the internet.

Thank you for your enquiry.

If at the date of his death your brother has not had any children and is not married his estate will pass to his siblings, if you are the only sibling then it will all pass to you. In that event you have predeceased your brother his estate will pass to your children, please see the intestacy rules flow chart.

Thank you Bryony

My brother did not leave a will,his savings are under probate ammount for bank,so my sister and I have decided we want to share the inheritance with my neices.How do I distribute the money to my sister and them without being under the £3000 gift rule,as its not my money I’m gifting

Thank you for your enquiry. The advice below is generic advice and you should contact us for specific advice based on your circumstances.

This advice assumes that your brother was not married, did not have children during his lifetime and his parents predeceased him and that your nieces are over 18 years of age.

If you and your sister are the only two people entitled to share in the estate of your brother you can proceed one of two ways, which was is best will really depend on your own individual circumstances and the amount involved.

One option would be to make a gift from yourselves to your nieces. You are correct in that if the amount you gift from your share of the inheritance is over £3,000 then the amount over the £3,000 will fall back in to your estate for inheritance tax purposes in the event of your death within seven years of the date of the gift. The gift is known as a potentially exempt transfer. If your estate is likely to be under the inheritance tax threshold (even with this amount added back in to it for tax purposes) then it’s not going to alter the tax position on your death, if however your estate will attract inheritance tax then you should consider the second option below.

The second option available to you is a deed of variation. If executed within two years of your brother’s date of death and drafted correctly the effect of the deed would be as though your brother left the amount directly to your nieces, there would therefore not be any further inheritance tax to pay.

If you require advice please do not hesitate to contact us.

Hi my Aunt has a will dated 1996 with her late husband being the sole beneficiary, my aunt has no children and the only surviving family are two nieces and two nephews. Would I be right in thinking that these 4 would be the beneficiaries due to intestate rules.

Also if Auntie was to complete a draft will then pass away due to failing health prior to signing master copy is there any way that the draft could be legal, or would you suggest that the draft is witnessed and signed whilst awaiting approval of master copy. Thanks for your help and assistance.

Thank you for your email.

If your aunt dies intestate, a widow who had no children during her lifetime her estate will be divided between her siblings, if any of those siblings have predeceased her then their share will be divided between their children. If you require further clarification please do not hesitate to contact us.

So far as signing a draft Will is concerned your aunt must take advice from her own legal advisor to ensure she understands the contents and it accords with her wishes before signing. A Will is valid as soon as it has been signed in the presence of two independent adult witnesses who must also sign in the Testators presence. It is important to ensure no pressure or undue influence is placed on your aunt to sign her Will as this may result in the Will being found to be invalid.

Good Evening

I was hoping you could advise me regarding a relation of mine, my aunt currently has a will however everything is left to her late husband, as the only surviving relative being her nephew could I possibly make a claim against her estate if she passed away prior to her completing a new will, which she is about to do.

Also if a will is in draft form prior to master being signed off by witness is it still valid, if the draft was witnessed ?

Thank you for your help

Regards John

Thank you for your enquiry.

If your aunt’s Will leaves her estate to her husband who has predeceased her and the Will does not set out where the estate will pass to in the event of her husband predeceasing her then in the event of your aunt’s death her estate will pass under the rules of intestacy.

For a Will to be valid it must be signed by the testator in the presence of two adult witnesses who must also sign in each other’s presence and in the presence of the testator. Whether the Will is in draft form or not makes no difference to the validity of a Will provided it is signed correctly.

If you have any further queries please do not hesitate to contact us.

I have an elderly auntie who doesn’t currently have a will in place, she has no husband, her parents and siblings have all passed away i’m her only relative being her nephew, under the current UK rules of intestacy would all her assets go to the crown or is it possible to rasie a claim against her estate? Thank you for your help and advice.

Thank you for your enquiry. If your aunt’s siblings had children themselves then the other nieces and nephews (or their children if they have predeceased) will be entitled to a share of the estate. If you were the only nephew born (and there were no nieces born) then you will be entitled to the whole of the estate provided your aunt did not have any children.

You will be the person entitled to apply for the Grant of Letters of Administration which will enable you to administer the estate. It would however be easier if your aunt made a Will, I would suggest raising the subject with her if you feel able to do so.

It is also extremely important to ensure she has considered appointing an attorney by way of a Lasting Power of Attorney to manage her affairs in the event she become incapable of doing so herself. Please do contact us if you have any other queries.

My father’s cousin has passed away with no will, he did not marry or have a civil partner, his parents and grand parents have all passed away. He had 18 cousins some who have passed away but they have surviving children, therefore is his estate split equally between all living relatives or do the cousins get an 18th of the estate with the children of the deceased cousins receiving their parents share split between them ?

Thank you

Thank you for your comment and please accept our condolences on your loss.

If your uncle died intestate (without a valid Will) and was not married or in a civil partnership at the date of his death, had no children during his lifetime (either natural or adopted), his parents and grandparents predeceased him and he had no siblings then his estate is divided equally between all of his cousins (on both sides of his family) if any cousins have predeceased him then their share passes on to their children.

I hope this has been of help to you, please do not hesitate to contact us if you have any further queries or require any assistance in obtaining the Grant of Letters of Administration or in the administration of the estate.

Hi, Thank you very much for the clarification, a second question what are the rules if a benificary relinquishes their claim to the estate and have no children ? is their share distributed between the other beneficiaries ?

There are two ways you can vary the distribution of an estate: The first is by way of a deed of disclaimer, this is where someone entirely disclaims their interest in an estate, their share then falls back in to the estate to be divided between remaining beneficiaries. The second way is by way of a deed of variation, this is where the beneficiary redirects their share of the estate somewhere else, this is often done for tax planning reasons.

If you have any further queries please don’t hesitate to contact us.

If the deceased leaves adult children (aged 18 and 20), by a former marriage, but before re-marrying / having any children by his intended spouse, is a statutory trust imposed until the age of 21 (or 25), i.e. the adult children have only a contingent interest, or are they of full age, for this purpose and have a vested interest (in equal shares) ?

The sister of a friend of mine is in this position – her fiancé died.

If a deceased person dies without a valid Will and the intestacy rules apply and if under those rules children are the only persons entitled to the estate of the deceased then the estate will pass equally to the children. Where there are adult beneficiaries they will take their share by virtue of surviving the deceased and at that time and where there are minor beneficiaries they will need to attain the age of 18 before their share can be paid to them.