Summary

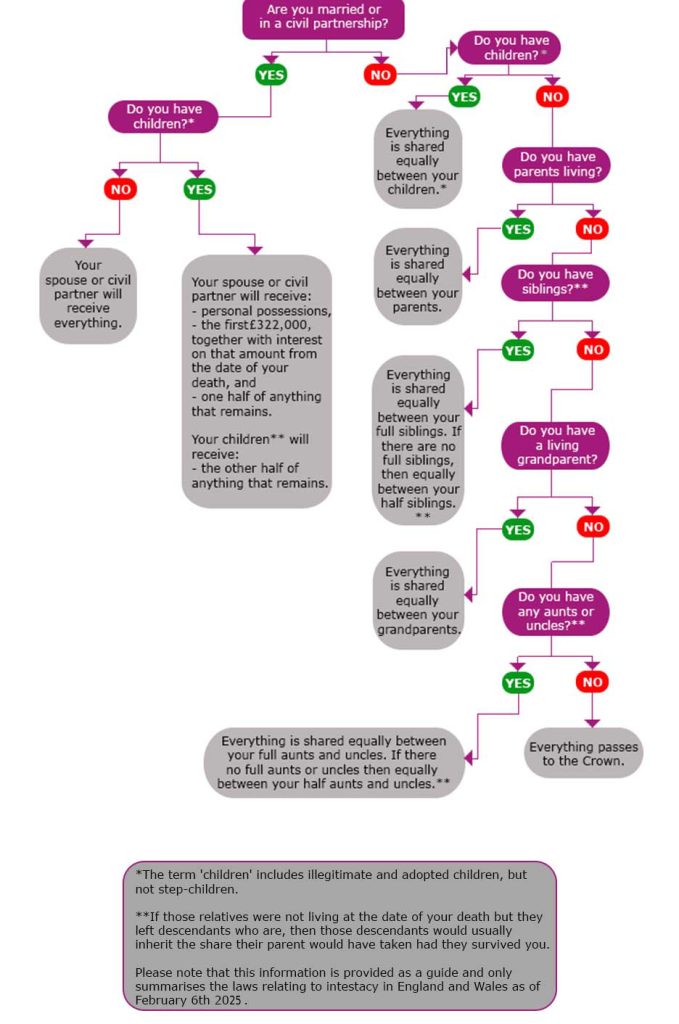

Our Intestacy Rules Flowchart goes through all the steps taken to decide what happens if you die without having a valid Will. It is important to stay informed about any legal updates to the Laws of Intestacy, as changes can significantly affect the distribution of assets.

If you have not written a will when you die, you are considered to have died ‘intestate’.

This chart shows what happens to your estate if you die intestate in England or Wales in 2025.

Key questions asked if you die intestate

Are you married or in a civil partnership?

You need to be either married or in a legal civil partnership for your other half to inherit your estate automatically.

Do you have any children?

If you are married or in a civil partnership, your children will receive half of your estate between them.

If you are NOT married or in a civil partnership, your children share your entire estate equally. They can make no variations to a Will because there is no Will.

What about the rest of your family?

Should you have no children, or no legal spouse / civil partner, your parents share your estate. If your parents are no longer alive, your estate is shared equally between any brothers and sisters you have.

If you have no siblings, then the estate reverts to your grandparents. And if you have no grandparents, to any aunts and uncles, equally.

And if no family are entitled to inherit?

If you have no legal spouse / civil partner, children, parents, siblings, grandparents, aunts or uncles, or cousins … the crown collects everything.

How do I stop this from happening?

Simple. If you want to have control over your estate and what happens after you have died, you need to contact your solicitor to make your Will.

Your life could end at any time, and it takes very little time to write a Will that protects those you care about when the worst happens.

Contact Cunningtons solicitors about making your Will – none of us want to think about it, but you’ll feel better once it’s done.

Visit our branches for more information: Braintree, Brighton, Chelmsford, Croydon, Hornchurch and Wickford.

Hi, My brother has just been contacted by an Heir Hunter company and we have just found out my Nan had a Niece who has passed away and they are now trying to find the beneficiaries of her estate.

It seems she had no Spouse/Children or other family members that are living, My Nan has passed and my father who was her son has also passed, she has a surviving daughter (My Aunty) will the estate of my Nans Niece be entirely left to my Aunty or will it be distributed between my Aunty and my Dads children?

Thank you for your enquiry.

The Heir Hunters will research your family tree to ascertain the relatives of your nan’s niece, once they have made contact with beneficiary they will verify identification and then usually provide a copy of the family tree. Without sight of the family tree I cannot accurately comment as to how the estate will be distributed. If your father would have ben a beneficiary under the rules of intestacy and predeceased then his share will pass to his children.

As you are now seeing the rules of intestacy can be complex, if you have not done so already I would urge you to consider having a Will which would set out who would deal with your estate and where it would pass to in the event of your death.

I have a brother who is single has never been married or has ever had a civil partner and has never had any children.

I am married and have 3 adult children.

neither of our parents or grandparents are still alive.

In the event of no will from my brother who will his estate go to?

My brother will not talk about any issues relating to death, he is now 68 and I am worried that myself or my children if I have passed may end up with a huge problem trying to sort this out.

Also are there any downloadable documents that clearly lay all this out that I can print off for him? He does not use computers or the internet.

Thank you for your enquiry.

If at the date of his death your brother has not had any children and is not married his estate will pass to his siblings, if you are the only sibling then it will all pass to you. In that event you have predeceased your brother his estate will pass to your children, please see the intestacy rules flow chart.

Thank you Bryony