“We lost out on our dream home because our buyer pulled out at the last minute” This all-too-familiar story highlights the fragility of property chains, where multiple transactions must align perfectly for anyone to move.

But what if there was a way to avoid this stress entirely? Enter the sell-wait-buy property strategy: selling your current home, and waiting before purchasing your next one.

Why Sell-Wait-Buy?

Although this approach sounds simple, it clearly comes with its own challenges. Uncertainties in the UK property market make it difficult to make rock-solid predictions, but there are some definite elements on their way in 2025 that may make it easier to decide.

Understanding the State of the Property Market

The UK property market is influenced by various factors that affect all participants, be they buyers or sellers. These issues are quite distinct from your personal circumstances, and you need to keep abreast of them if you want to make the best of your property transactions.

Stamp Duty Changes

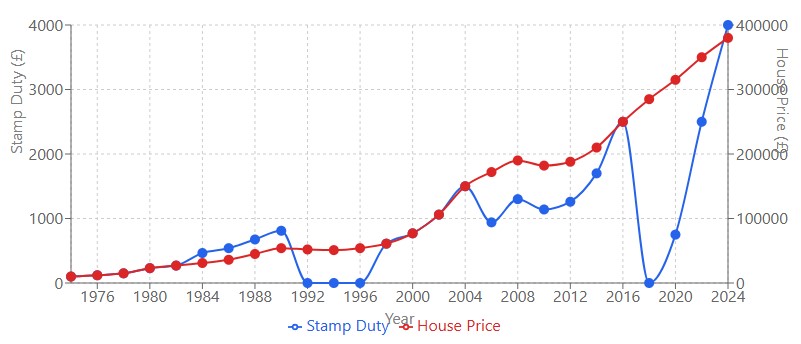

Rachel Reeves’ Autumn 2024 budget made a number of changes designed to impact the UK housing market.

These two key measures make substantial changes for homebuyers:

- lowering the Stamp Duty Land Tax (SDLT) threshold for first-time buyers from £425,000 to £300,000 and

- increasing the stamp duty surcharge on second homes from 3% to 5%.

These changes are expected to raise costs for buyers and investors, spurring a short-term rush to complete before they kick in on the 1st of April 2025.

The changes in the budget are also likely to cause some private landlords to leave the sector entirely, particularly as they come at a time of a further tightening up of the rental sector.

Labour’s Renters’ Rights Bill is likely to become law after Royal Assent later in April 2025. So despite the Stamp Duty rises from the budget, there could well be more ex-rental properties available to buy.

Interest Rates

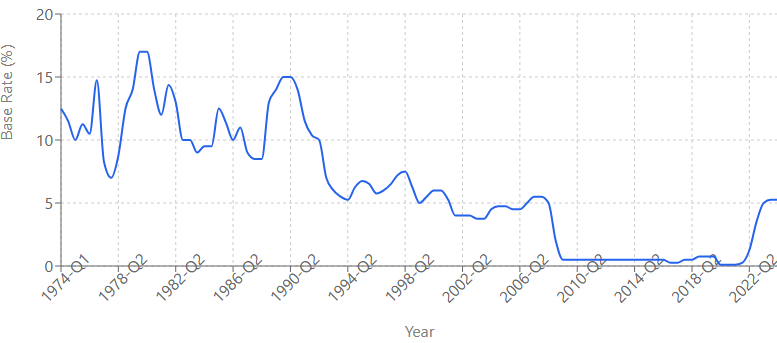

Another imponderable issue for all ends of the property market is the Bank of England’s base interest rate.

Having spent much of the time since 2009 at below 0.5%, it started to rise again in 2022, and it is currently hovering around the 4% mark. The impact on mortgage rates and affordability are huge, potentially encouraging those with multiple mortgages – such as landlords and other second-home owners – to exit the market.

It doesn’t look like interest rates are dropping to their pre-2022 levels again anytime soon, so any property choices you make in 2025 should bear this in mind.

Pros of Selling First Then Waiting To Buy

Bearing these issues in mind – which you always should do – we will go over the plus side of selling your home before buying another.

1 Gain Financial Clarity

If you sell your home before buying another, it allows you to benefit from a clear picture of your financial situation. You know exactly how much you have available to spend buying your next property, which means you’ll be unlikely to overextend your budget.

2 Avoid Dual Mortgages

Moving between two homes with mortgages at the same time can be financially stressful as you might end up in a situation when you have two payments due simultaneously. By selling first you eliminate this risk.

3 A Stronger Buying Position

As a buyer who has already sold their home, you would be far more attractive to a seller. You would be seen as a serious buyer who can move quickly.

4 The Chain-Free Advantage

If you become a chain-free buyer, you reduce delays and uncertainty. In a market with an increased number of properties – such as those offloaded by landlords leaving the rental market – this advantage can be especially valuable. Sellers might even be more willing to negotiate a price reduction, and your own personal stress levels drop too.

5 Reduced Pressure

Time is a luxury, and looking for a new home without so much time pressure means you don’t have to rush your decisions. You’ll have the breathing space to find your perfect home, and you’ll be able to wait until the right property comes onto the market.

If you can manage to sell first then buy slowly, it could really pay dividends – in terms of your mental health, at least. For instance, one Cunningtons’ client shared their experience of moving into their partner’s home after selling, house-hunting together, and then buying a home as a couple. This approach turned what could have been a stressful situation into an enjoyable and collaborative process.

Selling, Then Waiting … And Then Buying: The Downsides

Much as many of us would love to be able to sell a home, then wait a bit, then buy in your own good time, it is not always possible – or even desirable.

1 Temporary Housing Needs

If you don’t have a new home lined up, you need somewhere else in the meantime. Where are you going to live? And where are you going to keep your stuff? Finding a short-term let can be just as stressful as buying a new home, and who has friends or family with enough space to accommodate you?

Securing a standard short-term rental is no mean feat, especially if you are unsure of the length of the lease you will need. That is why sorting out your temporary housing needs is number 1 on our list of the downsides of stepping out of the property chain.

2 At The Mercy Of The Market

If you sell-buy rather than sell-wait-buy you’re working with a housing market that’s in the same condition throughout. If property prices then rise after you sell, you may find yourself priced out of where you want to buy. On the other hand, a declining market might work in your favour – but who’s to know?

3 Emotional Stress

When you sell you need to pack, move, and settle in, which is already stressful. If you need to do this twice it can be taxing, especially if you are a family and have to travel to schools and commute to work.

4 Stamp Duty Rise

If you don’t get everything done and dusted by April 1st 2025, you will be liable for increases in Stamp Duty, and you may have less available to spend buying your new home. Though it is possible that there will be a slight drop in house prices shortly after the start of April to compensate for the SDLT increase.

5 Potential Mortgage Issues

Moving your mortgage from your current home to a new one, or ‘porting’ your mortgage, might not be possible if you have a gap between property ownership. As a result, you might find yourself liable for a larger mortgage repayment fee than you had originally bargained for. Speak to your lender to check they’ll refund any charges when you complete a new mortgage. They’ll also tell you how long the window of opportunity is between selling and buying.

Planning For Sell-Wait-Buy

If you decide to take the sell first before buying option, you need to think about all stages carefully to get it right and be able to take full advantage of your situation.

1 Find Your Temporary Housing

This is absolutely key. If you can’t easily arrange for interim accommodation, you should stay with the traditional housing chain method, and sell-buy.

2 Sign Up With Property Professionals

Having your legal team ready ahead of time, as well as finding the right estate agent to work with can pay dividends.

You won’t have to rush around at the last minute if you have already instructed your conveyancing solicitor, and the right estate agent can give you tips on making the most from your property transactions. And a good mortgage advisor can keep an eye on the financial side for you.

If you take the sell-wait-buy route, you’re going to be in contact with your professional team quite a lot!

3 Prepare Your Home For Market

Whatever route you take in moving from one home to another, you will always have to be adept at to make your home stand out from the crowd and sell faster and for more money.

Read our guide to selling your home for more tips on getting it right.

4 Create a Financial Plan

One of the benefits of sell-wait-buy is that you can get a more accurate picture of your finances. Take advantage of this information so you can budget for your property purchase effectively – our guide to The True Costs Of Buying Your Home should help here.

Reaching Your Decision

Selling your home before buying another has clear benefits, particularly if you want financial certainty and to be able to negotiate your purchase from a stronger position.

However, in the coming year factors such as an influx of ex-rental properties and the effects of the most recent budget make it difficult to predict the state of the UK property market. While buyers may enjoy more choice, sellers might face stiffer competition.

Despite these nationwide issues, it is only by evaluating your own personal circumstances as well as market trends that you can make an informed decision that is right for you.

Whether you choose to sell first and buy straightaway, or sell then wait and buy later, careful planning and consultation with a trusted property professional can help make the process smoother and less stressful.

Choose The Right Conveyancing Solicitor

Wherever you are on your buying-selling property journey, you will need to have a reliable property solicitor on your side. You can ask Cunningtons for a conveyancing quote online, or come and see us at one of our branches.

We have conveyancing solicitors ready to help you at our offices in Braintree, Brighton, Chelmsford, Croydon, Hornchurch and Wickford.