Summary

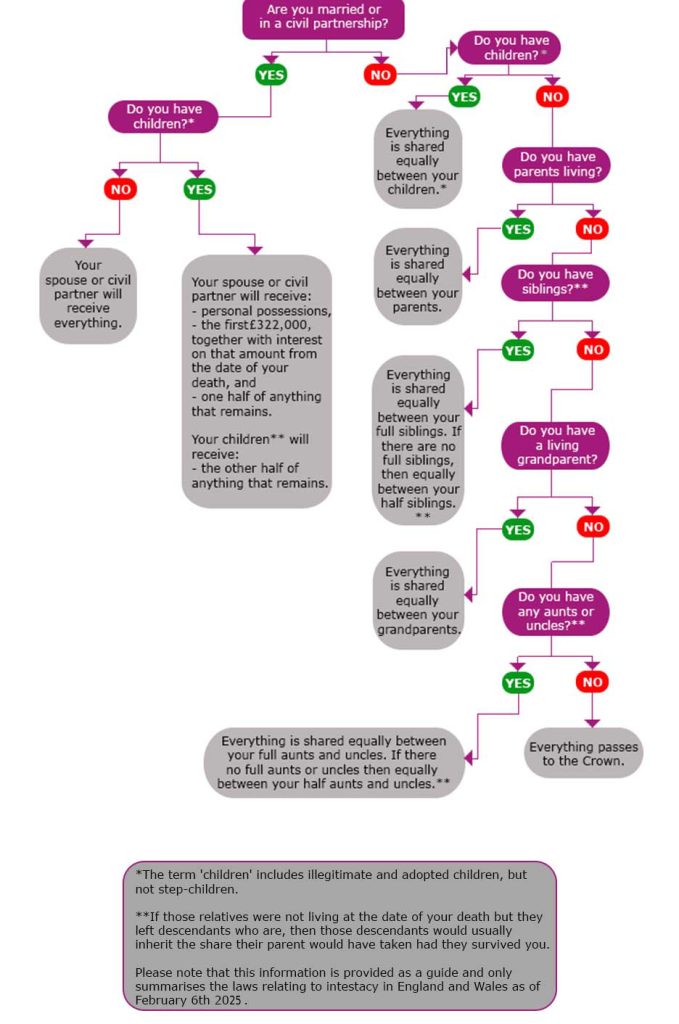

Our Intestacy Rules Flowchart goes through all the steps taken to decide what happens if you die without having a valid Will. It is important to stay informed about any legal updates to the Laws of Intestacy, as changes can significantly affect the distribution of assets.

If you have not written a will when you die, you are considered to have died ‘intestate’.

This chart shows what happens to your estate if you die intestate in England or Wales in 2025.

Key questions asked if you die intestate

Are you married or in a civil partnership?

You need to be either married or in a legal civil partnership for your other half to inherit your estate automatically.

Do you have any children?

If you are married or in a civil partnership, your children will receive half of your estate between them.

If you are NOT married or in a civil partnership, your children share your entire estate equally. They can make no variations to a Will because there is no Will.

What about the rest of your family?

Should you have no children, or no legal spouse / civil partner, your parents share your estate. If your parents are no longer alive, your estate is shared equally between any brothers and sisters you have.

If you have no siblings, then the estate reverts to your grandparents. And if you have no grandparents, to any aunts and uncles, equally.

And if no family are entitled to inherit?

If you have no legal spouse / civil partner, children, parents, siblings, grandparents, aunts or uncles, or cousins … the crown collects everything.

How do I stop this from happening?

Simple. If you want to have control over your estate and what happens after you have died, you need to contact your solicitor to make your Will.

Your life could end at any time, and it takes very little time to write a Will that protects those you care about when the worst happens.

Contact Cunningtons solicitors about making your Will – none of us want to think about it, but you’ll feel better once it’s done.

Visit our branches for more information: Braintree, Brighton, Chelmsford, Croydon, Hornchurch and Wickford.

I have an elderly auntie who doesn’t currently have a will in place, she has no husband, her parents and siblings have all passed away i’m her only relative being her nephew, under the current UK rules of intestacy would all her assets go to the crown or is it possible to rasie a claim against her estate? Thank you for your help and advice.

Thank you for your enquiry. If your aunt’s siblings had children themselves then the other nieces and nephews (or their children if they have predeceased) will be entitled to a share of the estate. If you were the only nephew born (and there were no nieces born) then you will be entitled to the whole of the estate provided your aunt did not have any children.

You will be the person entitled to apply for the Grant of Letters of Administration which will enable you to administer the estate. It would however be easier if your aunt made a Will, I would suggest raising the subject with her if you feel able to do so.

It is also extremely important to ensure she has considered appointing an attorney by way of a Lasting Power of Attorney to manage her affairs in the event she become incapable of doing so herself. Please do contact us if you have any other queries.

My father’s cousin has passed away with no will, he did not marry or have a civil partner, his parents and grand parents have all passed away. He had 18 cousins some who have passed away but they have surviving children, therefore is his estate split equally between all living relatives or do the cousins get an 18th of the estate with the children of the deceased cousins receiving their parents share split between them ?

Thank you

Thank you for your comment and please accept our condolences on your loss.

If your uncle died intestate (without a valid Will) and was not married or in a civil partnership at the date of his death, had no children during his lifetime (either natural or adopted), his parents and grandparents predeceased him and he had no siblings then his estate is divided equally between all of his cousins (on both sides of his family) if any cousins have predeceased him then their share passes on to their children.

I hope this has been of help to you, please do not hesitate to contact us if you have any further queries or require any assistance in obtaining the Grant of Letters of Administration or in the administration of the estate.

Hi, Thank you very much for the clarification, a second question what are the rules if a benificary relinquishes their claim to the estate and have no children ? is their share distributed between the other beneficiaries ?

There are two ways you can vary the distribution of an estate: The first is by way of a deed of disclaimer, this is where someone entirely disclaims their interest in an estate, their share then falls back in to the estate to be divided between remaining beneficiaries. The second way is by way of a deed of variation, this is where the beneficiary redirects their share of the estate somewhere else, this is often done for tax planning reasons.

If you have any further queries please don’t hesitate to contact us.

If the deceased leaves adult children (aged 18 and 20), by a former marriage, but before re-marrying / having any children by his intended spouse, is a statutory trust imposed until the age of 21 (or 25), i.e. the adult children have only a contingent interest, or are they of full age, for this purpose and have a vested interest (in equal shares) ?

The sister of a friend of mine is in this position – her fiancé died.

If a deceased person dies without a valid Will and the intestacy rules apply and if under those rules children are the only persons entitled to the estate of the deceased then the estate will pass equally to the children. Where there are adult beneficiaries they will take their share by virtue of surviving the deceased and at that time and where there are minor beneficiaries they will need to attain the age of 18 before their share can be paid to them.